WATCH OUT FOR CONVENTIONAL WISDOM

As originally appeared in The Jerusalem Post on April 25th, 2019.

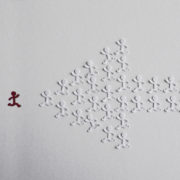

Swim upstream. Go the other way. Ignore the conventional wisdom.

-Sam Walton

A few days ago our family did a navigation game in Old Jaffa. I highly recommend it as it was both educational and lots of fun. As part of the navigation challenge, we were asked questions about Israel. One of the questions was “True or false: Israel is the world’s largest hi-tech center?” My kids wrote true and when I asked them why they said because they always hear about Start-up Nation, and all the cool things going on with Israeli ingenuity so Israel must lead the world. When their cellphones showed a big red “X” they were shocked. I asked them if they had ever heard of Silicon Valley?

Too often, people just accept certain mantras as truth, without ever questioning the logic behind them. Case in point the hoopla surrounding Earth day. In a USA Today article that actually also ran in The Jerusalem Post, Doyle Rice and Elizabeth Weise write, “Climate change is real and increasingly a part of our daily lives.” They continue, “There’s no longer any question that rising temperatures and increasingly chaotic weather are the work of humanity. There’s a 99.9999% chance that humans are the cause of global warming, a February study reported. That means we’ve reached the “gold standard” for certainty, a statistical measure typically used in particle physics.”

99.9999% chance? Ever hear of volcanoes and sun spots?

Then there is an article from Alliance Bernstein written by James T. Tierney, Jr. and David Tsoupros, of the Concentrated US Growth fund, on “Climate proofing an equity portfolio”. They write, “From rising sea levels to catastrophic weather events, investors can’t afford to ignore the risks of climate change. Since many companies would be vulnerable if current climate forecasts materialize, asset managers may want to consider climate change in their equity research process and engage management teams on the subject.” They continue, “By 2100, the planet could be as much as 4.4 degrees Celsius warmer than it is today.”

They are telling us what will happen to the climate in 80 years from now, while their same modeling can’t predict the weather forecast for this coming Monday. Yet, no one says anything because this has become the accepted opinion.

It is incumbent upon us to challenge these assumptions, especially when our Talmudic tradition is based upon constant challenging of positions, in order to ascertain the truth.

The financial media pushes its own conventional wisdom, and I would like to challenge a few of their assumptions. Needing 80% of pre-retirement income in order to retire and drawing down 4% of your portfolio annually.

How much money for retirement?

How much income does one need in retirement? Do a Google search and you will get answers ranging from 75-80% of your pre-retirement income. This is caused by lower tax rates, no more money being fed into retirement accounts and no more mortgage. Unfortunately for many retirees, especially those retired in Israel, this number has little basis in reality. When a couple retires they will often find that their expenses are different. It is therefore important to sit down and make a realistic new plan based on these changes. As I have written here many times, I am a bit more cautious with my clients as I apply a basic equation: Leisure=money spent. After retiring, people find themselves with more free time, and they may want to use it to travel, eat out, or for other leisure activities. In fact, the more time that a person has available increases the chances that he will spend more money. Then there is the other issue. We all know that ‘making’ it in Israel isn’t so easy. Many retirees that I sit with have an immediate goal of helping out their children as well. That help can take the shape of direct financial support or “Grandparents Tuesday” (the day that Sabba and Savta pick up their beloved grandchildren and buy them ice cream, falafel, etc)!

Income stream

Once you have a handle on your income needs, you should go ahead and create an income stream. Forget about the 4% drawdown rule. In many instances, you can create a portfolio that will be able to generate the income you need without having to draw down principal. Dividend-paying stocks and hedged international bonds are good ways to balance a portfolio and generate much higher levels of income than you will generate with U.S. government bonds or certificates of deposits. Why draw down principal if you don’t have to?

Tune out the noise

Don’t rely on conventional wisdom when planning your retirement. Sit down with an adviser and start figuring out your goals and needs. Some solid planning will go a long way toward financial peace of mind.

The information contained in this article reflects the opinion of the author and not necessarily the opinion of Portfolio Resources Group, Inc. or its affiliates

Aaron Katsman is author of the book Retirement GPS: How to Navigate Your Way to A Secure Financial Future with Global Investing (McGraw-Hill), and is a licensed financial professional both in the United States and Israel, and helps people who open investment accounts in the United States. Securities are offered through Portfolio Resources Group, Inc. (www.prginc.net). Member FINRA, SIPC, MSRB, FSI. For more information, call (02) 624-0995 visit www.aaronkatsman.com or email aaron@lighthousecapital.co.il.