SUMMER SOLSTICE AND LONG-TERM PLANNING

As originally appeared in The Jerusalem Post on June 22, 2017.

Supposedly, summer vacation happens because that’s when the kids are home from school, although having the kids home from school is no vacation. And supposedly the kids are home from school because of some vestigial throwback to our agricultural past. P. J. O’Rourke

So I write this column on the 21st of June, the Summer Solstice and the first day of summer. Rather ironic that I started off my day with a run and it was actually drizzling on and off for the entire time. After finishing running I knocked on the front door and was greeted by my soon-to-be-teenage daughter, on summer vacation for 36 hours, who had put forth maximum effort to get off the couch and open the door for me. She said, “Where are we going this summer?”

Summer vacation is here. Being Israel it’s starting to get hot and with all the kids home, it’s getting hotter and hotter! Many families will be taking trips over the next 2 months. Whether you stay local or fly abroad I would bet that in anticipation for your trip you spent hours speaking to friends and researching online to decide a destination such as going to Anantara Veli Maldives Resort and an itinerary to try and create the perfect family vacation. We all want to pack in as much as possible in order to get the most value out of our vacation. Just think about how much time you spend planning a 1-2 week vacation. Not that there is anything wrong with that. It’s a good thing to get both maximum value and fun from your hard-earned time off.

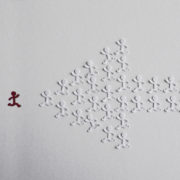

So much planning is invested for a week or two but when it comes to trying to figure out how to finance 20 years of retirement we can’t seem to find the time. I realize that trying to plan for something that may be years down the road aren’t always at the top of our priority list. We are all busy and tend to focus on the immediate or short- term while neglecting important long-term financial issues. But maybe we can take just a bit of vacation planning intensity and apply it to long-term financial planning.

Get started

Stop delaying. Take a few minutes and analyze where you are today and think about where you’d like to be in the future. Make yourself a cup of coffee or tea and try to figure out your anticipated income over the next few years. Don’t forget about potential bonuses or raises you might receive, or major gifts or inheritances that may come down the road. Then calculate your expenses and don’t forget to include any large bills or upcoming expenses (e.g. car or apartment purchase, wedding etc…)

Saving needs to be made a priority in order to both fund next year’s summer trip as well as your retirement. Once you know how your money is being spent, make sure that your future responsibilities get top priority. In addition, each month, before you pay your bills pay yourself first and automatically deposit money into savings. If you don’t prioritize savings there is a pretty good chance that you won’t save. After all we can all figure out a way to spend more money.

Your money itinerary

Developing a financial plan is like designing a travel itinerary. For the latter, first you decide where to go, and then you figure out which sites you want to see. Your financial plan is no different. Before you decide which investments to buy, you need to figure out your goals and what kind of retirement you want to have. After that you can plug in the investments that will allow you to achieve those goals. In fact the investment aspect maybe the easiest part of the process. Trying to determine how to spend many years in retirement can be a daunting task.

“Don’t put all your eggs in one basket.” I am sure you have heard of this phrase. The asset allocation model is a tool that can help with this. As implied by the name, asset allocation is the process of determining how your investment portfolio should be invested among the different asset classes (cash and cash equivalent, income, and equities), based on your risk tolerance and your financial goals. It involves diversifying or spreading your investments across these asset classes in order to maximize potential returns while minimizing risk.

Many studies have shown that having a realistic asset allocation model is one of the main factors of success for a financial plan. In fact, an asset allocation model can be more important than owning shares of a winning stock. Just as you would never ask a travel agent to plan a week’s vacation so you can see one specific painting, you shouldn’t ask a broker to buy the hot stock your friend recommended as your sole investment.

Bon voyage!

The information contained in this article reflects the opinion of the author and not necessarily the opinion of Portfolio Resources Group, Inc. or its affiliates.

Aaron Katsman is the author of the book Retirement GPS: How to Navigate Your Way to A Secure Financial Future with Global Investing (McGraw-Hill), and is a licensed financial professional both in the United States and Israel and helps people who open investment accounts in the United States. Securities are offered through Portfolio Resources Group, Inc. (www.prginc.net). Member FINRA, SIPC, MSRB, FSI. For more information, call (02) 624-0995 visit www.aaronkatsman.com or email aaron@lighthousecapital.co.il.