Snow and Stock Market Predictions

As originally appeared in The Jerusalem Post on February 21, 2025.

“Would you bet your paycheck on a weather forecast for tomorrow? If not, then why should this country bet billions on global warming predictions that have even less foundation?” -Thomas Sowell

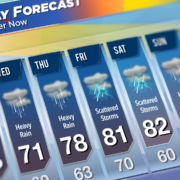

Will it snow in Jerusalem? That question has been front and center for residents of the capital for the last week. The Jerusalem Forecast’s model has been dueling with the Yerushamayim weatherman on when and how much if any snow will pile up in the city. A few nights ago, after the weather forecast on one of the TV channels, I turned to our 2 youngest children and asked them if they learned about climate change and global warming in school. They were both engrossed in their phones and mumbled something that I was unable to understand. I made the comment that the next time a teacher starts preaching about these issues, just ask them how they know what will happen to the weather 50-100 years from now if they can’t figure out if it will snow in the next 72 hours! Our youngest then said something along the lines of, “These issues don’t interest me, let me get back to the video on banana cake that I’m watching!”

Writing about the difficulty in predicting snow, meteorologist Clay Mallot of SnowBrains writes, “Snowfall is a puzzle in the forecasting world, with every piece tangled in complex atmospheric dynamics, chaotic patterns, and ever-shifting terrain influences. Predicting snow isn’t like projecting temperatures or wind speeds; it requires pinpointing two crucial variables: precipitation and temperature. Chaos theory helps us understand why this is so challenging. In a chaotic system like the atmosphere, tiny shifts in conditions can drastically alter the weather days later. A small fluctuation can turn a forecasted mild winter day into a snowstorm in just a few hours. This unpredictable behavior can make it feel like the atmosphere has a mind of its own.”

Bad feeling

Recently I have spoken to a few prospective clients who told me that they have money to invest but want to wait because the market is ‘high’. This is actually something I hear frequently. Especially after the market drops and I speak with clients about maybe investing some of the money they have sitting around in cash, I often receive responses like “I have a bad feeling about the market” or “I want to make sure that the market is going up before I invest”. This leads to an issue that I have mentioned numerous times, and that’s that investors who try and predict the future, or in investing parlance “timing the market” usually end up with lower returns than investors who stay the course and are fully invested.

Marc Daner of Daner Wealth Management writes, “One study looked at the track record of stock market “experts” who predicted the market’s direction. Their findings were eye-popping.

Overall, their accuracy rate was only 47%, less than you might expect from random chance.” He continues, “ Over 20 years from 2002-2021, another report found the average difference between target price estimates from stock market “experts” at the beginning of the year and actual prices of the index for the same year was a staggering 8.3%.”

As I have mentioned before, Humphrey Thomas, CEO of HG Thomas Wealth Management, writing for CNBC.com, “Longer-term approaches are a better strategy. JP Morgan compiled some research showing the importance of this. They tracked the performance of a $10,000 investment in the S&P 500 over a 20-year period. It showed a healthy average return of 9.85 percent per year. But they modeled what would happen if the investor withdrew from the market temporarily and missed the 10 biggest days on the stock market for that 20-year period (just 10 days out of 7,304). The result was a reduced return from 9.85 percent to 6.1 percent, which means a decrease of $32,665 in gains. And the more days missed, the lower the gains fell.”

Thomas then continues and brings an incredible statistic. “Nobel laureate William Sharpe found that “market timers” must be right an incredible 82 percent of the time just to match the returns realized by buy-and-hold investors.”

The 82% hit rate is virtually impossible to accomplish. If most professionals can’t even come close to that kind of success rate, then a retail investor has almost no chance. You might be right once or twice, but that’s as much success as you will achieve.

Just like weatherman can’t predict what the weather will be, so to market timers can’t continuously predict the direction of the market. The tried and tested way to make money in the market is to be in it for the long-term. I hate cliché’s but in this case there is a good one about the way to make money by investing. “It’s time in the market, not trying to time the market.” Before investing, figure out your goals and needs and then create a portfolio that will enable you to achieve whatever it is that you are trying to accomplish financially. Then allocate the money accordingly and that will help you manage risk and ease the market roller coaster. That is a much better formula for success than trying to predict the future.

The information contained in this article reflects the opinion of the author and not necessarily the opinion of Portfolio Resources Group, Inc. or its affiliates.

Aaron Katsman is the author of Retirement GPS: How to Navigate Your Way to A Secure Financial Future with Global Investing (McGraw-Hill), and is a licensed financial professional both in the United States and Israel, and helps people who open investment accounts in the United States. Securities are offered through Portfolio Resources Group, Inc. (www.prginc.net). Member FINRA, SIPC, MSRB, SIFMA, FSI. For more information, call (02) 624-0995 visit www.aaronkatsman.com or email aaron@lighthousecapital.co.il.

Leave a Reply

Want to join the discussion?Feel free to contribute!